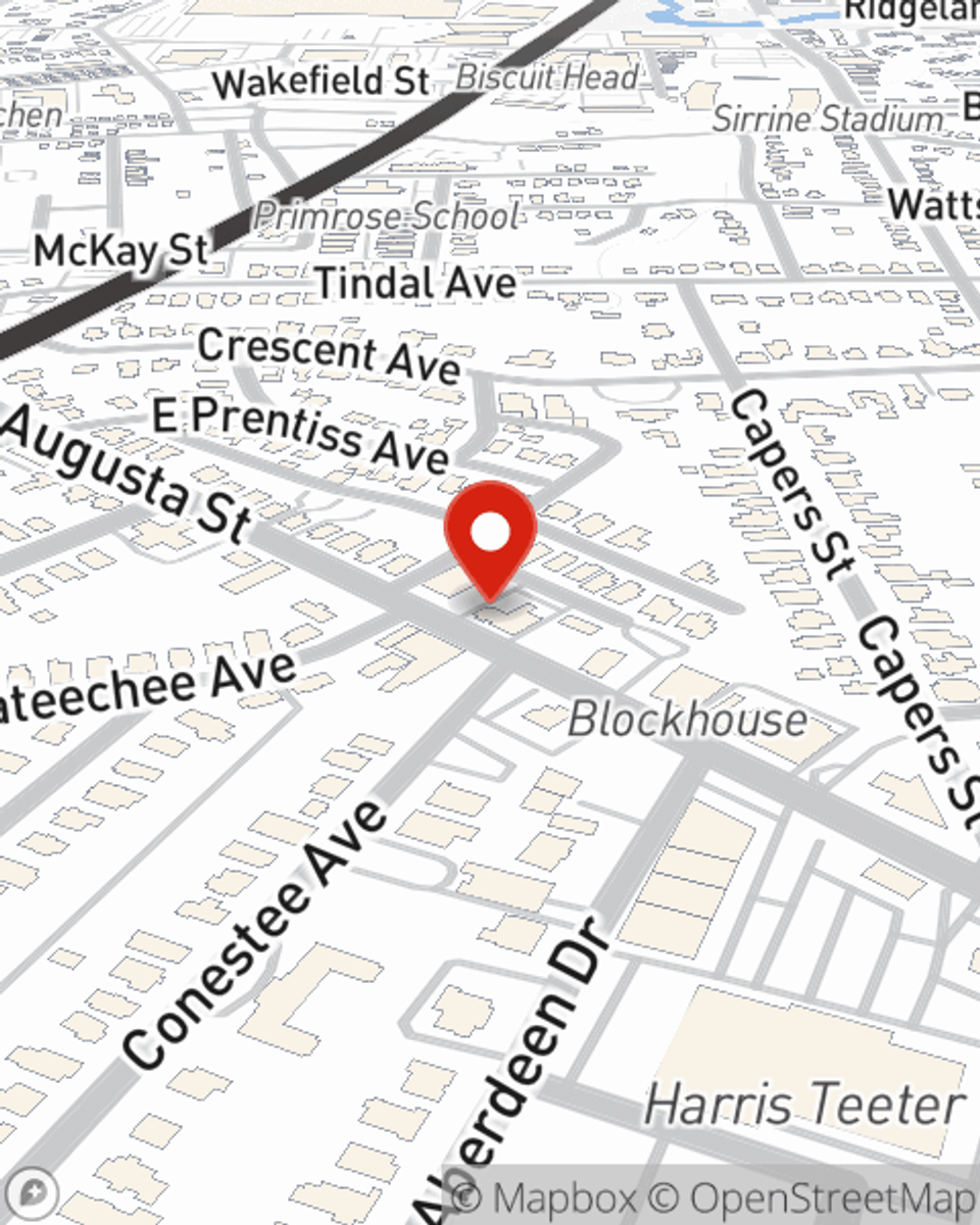

Business Insurance in and around Greenville

One of the top small business insurance companies in Greenville, and beyond.

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

Owning a business is about more than being your own boss. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for the ones you care for. Because you give your all to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with extra liability coverage, business continuity plans and errors and omissions liability.

One of the top small business insurance companies in Greenville, and beyond.

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Joe Bond for a policy that covers your business. Your coverage can include everything from errors and omissions liability or business continuity plans to professional liability insurance or employment practices liability insurance.

Call or email agent Joe Bond to discuss your small business coverage options today.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Joe Bond

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.